Nordea: Novo price trigger ahead

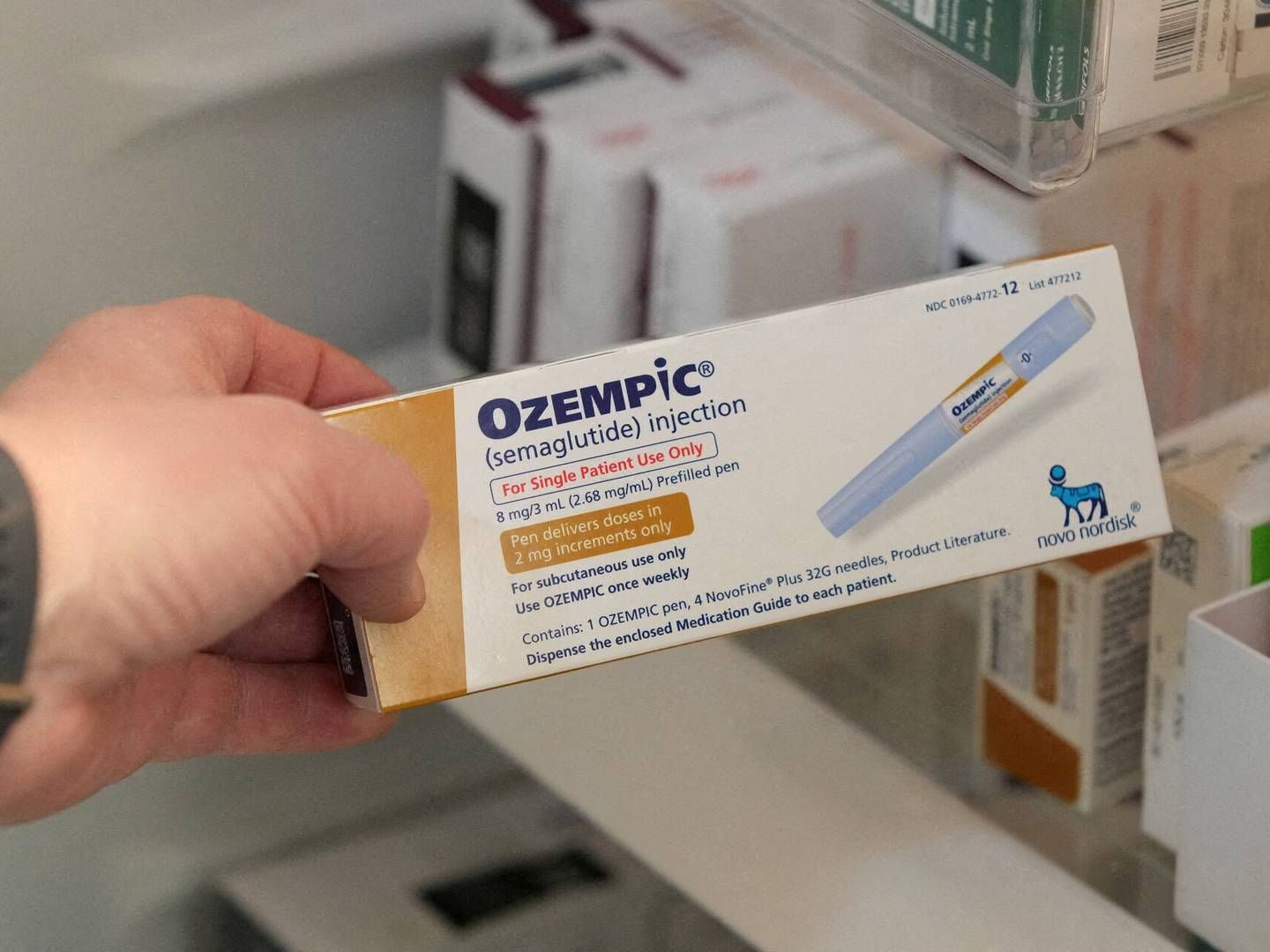

With 14 votes in favor and only one against, an FDA advisory panel had no doubts: Novo should win approval for their drug to treat obesity, Saxenda. Later today (Monday) the agency will make its decision and it is likely to come out in favor of Novo. If it does, it should have an impact on the Danish group’s share price, the Scandinavian bank Nordea writes in an update.

“The share price is now below the level from before the advisory panel gave its recommendation of Saxenda to treat obesity, even with Friday’s gain [of 4.5%]. The US approval agency will make a final decision on the approval of Saxenda today. We expect it to come out in Novo’s favor, which should lead to further price increases. Consequently, we see good short and long term value in the share,” Nordea writes.

The bank has a target price of DKK 335 per Novo share with a ‘strong buy’ recommendation. The closing price Friday was DKK 258.2. US investment bank Morgan Stanley released a large analysis of Novo Nordisk recently, revealing an expectation that Saxenda could cross the USD 1 billion mark as soon as 2020 – making it a blockbuster drug.

- translated by Martin Havtorn Petersen

Would you like to receive the latest news from Medwatch directly in your e-mail inbox? Sign up for our free english newsletter below.

Relaterede artikler

Novo chief: I avoided a heart attack

For abonnenter

Here is the obstacle for Novo’s obesity approval

For abonnenter