Ambu shareholders criticize "way too conservative" forecast – seven guidance upgrades in three years

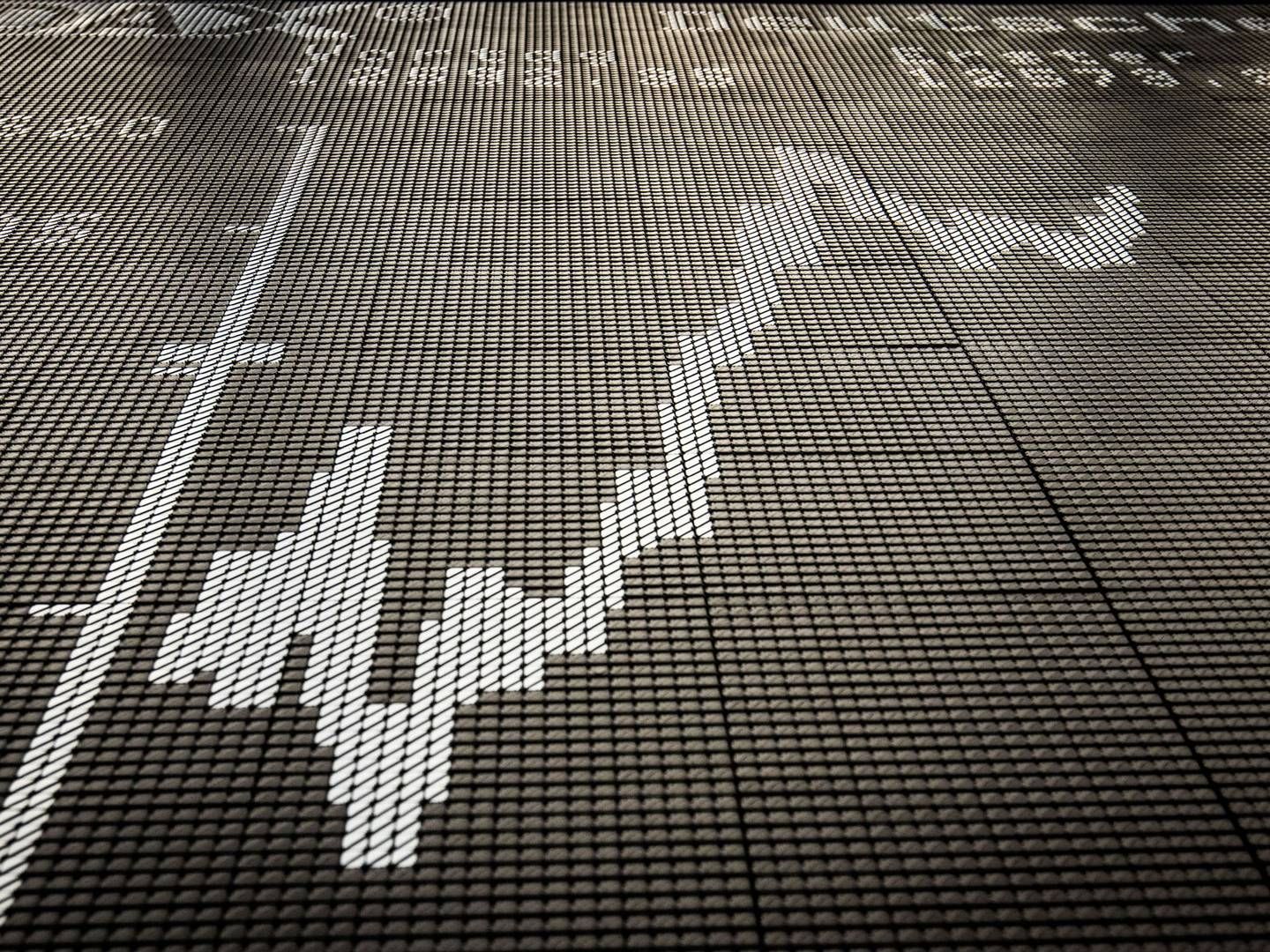

There is no doubt that the investors are keen on Ambu. Since the beginning of 2016, the company’s share has risen by 539 percent stimulated by a rapidly increasing revenue and results.

But several times, Ambu’s growth was supported by guidance upgrades in which the company gave guidance about the annual results and revenue only to increase it later the same year.

Ambu has raised its guidance seven times since January 2016 and though this is usually good news for the investors, Managing Director at the Danish association of small private shareholders, Leonhardt Pihl, is not excited about the statistics.

“We do absolutely not think that the administration deserves a pat on the back,” says Pihl in an interview with MedWatch.

“As an association we want full and satisfactory information. It is not good practice when an administration regularly, and more or less permanently, declares ‘we were too conservative in the last quarter and therefore, we raise the guidance’,” the Managing Director continues.

According to Pihl, the seven guidance raisings are no good neither for the company’s reputation nor for the shareholders.

“I don’t think the market falls for that. The market will quickly figure out this systematism and take it into account. I actually think that Ambu’s share price would increase if the company provided more realistic forecasts and guidance,” he says.

In November 2017, when Ambu reported the annual accounts 2016/2017 that was right on all estimates and maintained the guidance for the next year, the company’s share price fell by 7.9 percent.

“We clearly prefer realistic and trustworthy forecasts. We consider it a very unfortunate tendency when Ambu constantly guides below the estimates,” says Pihl.

For Ambu, raising the guidance has resulted in several booms in the share price even though many guidance raisings also coincide with financial reports that raised the price.

It was the case of the company’s latest guidance raising in May, when the Ambu presented the Q2 interim report and the share price increased by 17.9 percent afterwards.

“Under-promiser and over-deliver”

According to CEO in Ambu, Lars Marcher, the company promises little and yields a lot.

“With Ambu the investors get an under-promiser and over-deliver,” he says to MedWatch and adds:

“If you look at Ambu’s way of handling guidance, you will see that we are relatively conservative. You can fact-check and see that we during the past two-three years raised our guidance seven times.”

According to Marcher, Ambu’s maintains a conservative guidance due to positive response from the shareholders.

“Our shareholders do think it is something exciting,” he says.

When he is confronted with the critique from the Danish Shareholders' Association, Marcher answers that Ambu “always gives guidance on basis of the best possible overview.”

“Ambu guides the market based on what knowledge we have got. We give guidance for one year at a time and in some areas, we just happen to deliver more than expected. We are very happy about that and so are our investors. So, I don’t understand the Shareholders' Association’s critique, which is not backed by the many investors we meet,” he says.

MedWatch: Considering the last seven guidance upgrades, wouldn’t it be better to give less conservative and more realistic guidance?

“As I said, we are very realistic in our forecast. The fact that we do better than what I say is something the shareholders like. That Ambu sets serious goals and is able to exceed them,” answers Marcher.

Blurred lines

Jakob Kaule, Head of Surveillance at Nasdaq Copenhagen, does not want to comment specifically on Ambu. However, he says that the limits for how conservative guidance a publicly listed company can give are generally blurred.

On the one hand, it is fully permitted to be conservative. On the other, a company cannot deliberately aim too low regarding the guidance.

“There is nothing wrong with being conservative but you have to guide as realistically as possible. It is about the relationship of trust between the company, the investors, and the analysts. A company may not deliberately give wrong guidance. That is misleading the market,” says Kaule and stresses that rules apply whether you exaggerate or understate.

“Basically, companies must be as realistic as possible when they give guidance. And they must inform about the conditions that form the basis for the guidance,” he says.

According to Kaule, the rules regarding companies’ guidance are so unclear because there is not concrete description for how companies are to handle forecasts.

“There is no formula for how a company should give guidance. Some companies guide conservatively. Some guide broadly. Some guide by stating a positive result or a better result than last year,” he says.

The Head of Surveillance also points out that giving guidance might be significantly harder in certain industries.

“Some companies can with much certainty guide two or three years ahead whereas others are more sensitive to fluctuations,” he explains.

Ambu is not the only life-science company to raise the guidance several times during the past years. For instance, Allerød-based Chemometec, that produces call counting and evaluation devices, raised its guidance seven times since October 2015. Since then, Chemometec’s share price has increased by 350 percent.

The past year’s massive rise in Ambu’s share price has resulted in a market value of USD 8.87 billion, which is more than for instance GN Store Nord.

English Edit: Ida Løjmand

Would you like to receive the latest news from MedWatch directly in your e-mail inbox? Sign up for our free English newsletter below.

Medtech giant launches attack on Ambu's future hope

Ambu chief excited about financial report and is looking forward to new investments

Relaterede artikler

Medtech giant launches attack on Ambu's future hope

For abonnenter

Ambu CEO: We have entered a new league

For abonnenter