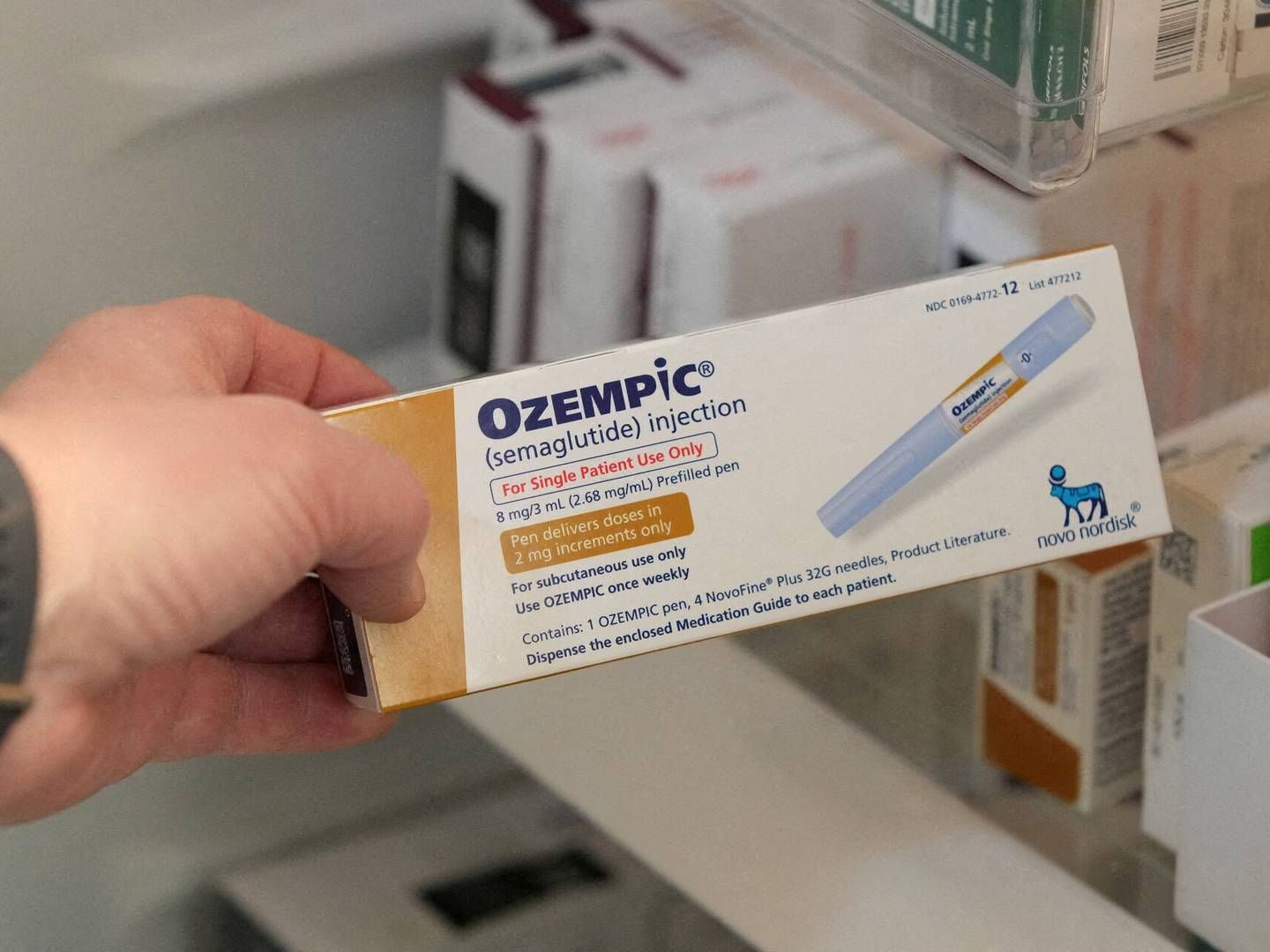

Novo Nordisk jumps on the discount wagon

Prices on medicine, not least to treat diabetes, have come under pressure in the US lately. The Danish drug group Novo Nordisk and a number of its nearest rivals have felt that pressure already.

While France’s Sanofi and US-based Eli Lilly have proved more willing to offer discounts on some of its products, Novo has taken a tougher stance, believing in the power of its innovative products.

But the hard surface has shown signs of cracking lately with Novo announcing a cap of price increases, for example, and now the group has agreed to offer a significant discount on some of its older insulin products in the US, it said on the website of its North American unit last week.

Up to 80 percent

The healthcare and pharmacy giant CVS Health has launched a new prescription savings program dubbed Reduced Rx that Novo Nordisk is going to take part in.

The program will give patients a discount on some drugs through CVS’ pharmacy benefits manager CVS Caremark, and some patients with diabetes can look forward to paying just USD 25 for a 10 ml. vial of Novo’s insulin products Novolin R, Novolin N, and Novolin 70/30. It reflects a potential saving of as much as USD 100 or 80 percent of the price.

“This program underscores how important collaboration is to addressing the affordability challenges patients face in certain health plans or who remain uninsured. We all have a role to play and that’s why we welcomed the chance to work with CVS Health on this program,” says Doug Langa, senior vice president and head of North America Operations for Novo Nordisk, who replaced Jakob Riis recently.

Patients who are either uninsured or have high out-of-pocket expenses through their insurance plans will benefit from the new savings plan. Sydbank analyst Søren Løntoft Hansen says it makes good sense for Novo Nordisk.

“It’s a really positive signal from Novo Nordisk and CVS looking at the debate about drug prices in the US. The loss of revenue from the lower price will be more than made up for by the positive effect in the current negative debate about high drug prices,” he tells MedWatch.

Changing tune

Shortly before the turn of the year, Eli Lilly announced a discount plan that would shave up to 40 percent off the price of insulin for uninsured Americans.

At the time, Jakob Riis said the initiative was positive, but that Novo Nordisk would be looking to take a different route.

“In Novo Nordisk, we are currently working with our partners on the US market on sustainable initiatives that both increase market transparency an access to our insulin portfolio,” the then-US head told Danish business daily Børsen.

Jakob Riis said that rather than giving cheaper insulin to patients outside of the reimbursement system, companies should find solutions to bring the patients in to the reimbursement system.

But Riis is history in Novo Nordisk, Doug Langa is the future, and it looks like the company has changed its tune.

“I think we will see more of these types of announcements in the coming years. They would like to offer the older drugs at a reasonable price to uninsured or poorly insured people with very high medicine expenses. These partnerships are the beginning of a new dynamic in the relationship between drug companies and purchasing organizations, which haven’t exactly been known for their willingness to collaborate. But there’s political pressure on the sector now, so we will see a higher degree of collaboration between these players,” says Søren Løntoft Hansen.

Older products

Pharmacy benefit managers are middlemen between drug companies and major health insurance providers in the US. They negotiate prices with the pharma companies and sell bundles of medicine to the companies that provide health insurance to millions of Americans.

Consequently, it is extremely important for drug companies to have their products included on the formularies of preferred drugs the PBM’s decide on every year.

A number of Novo Nordisk’s products have been removed from the formulary of the country’s biggest PBM, Express Scripts, including cash cow Victoza, older insulin products from its Novolog and Novolin brand families. But the Danish drug group is still in favor with CVS, the country’s second largest PBM.

Novolin belongs to the company’s human insulin portfolio. Novo does not disclose sales figures for the drug itself, but the category on a whole generated revenue of more than DKK 11 billion (USD 1.6 billion) last year, while the modern insulin portfolio generated sales of DKK 47.5 billion.

It must be noted that the sales of human insulin in the US was at a “mere” DKK 1.83 billion last year. So it is clearly an older and less lucrative part of Novo’s business that will be affected by the new savings program at CVS, which patients can enroll in from May this year.

Open letter from Novo VP: We will limit price hikes

Pension fund sues Novo Nordisk and two top execs

New lawsuit creates more uncertainty for Novo Nordisk

The head of Novo Nordisk’s US business has resigned

Novo’s US head is ready for turnaround

English edit: Martin Havtorn Petersen

Would you like to receive the latest news from MedWatch directly in your e-mail inbox? Sign up for our free English newsletter below.

Relaterede artikler

Open letter from Novo VP: We will limit price hikes

For abonnenter

New lawsuit creates more uncertainty for Novo Nordisk

For abonnenter