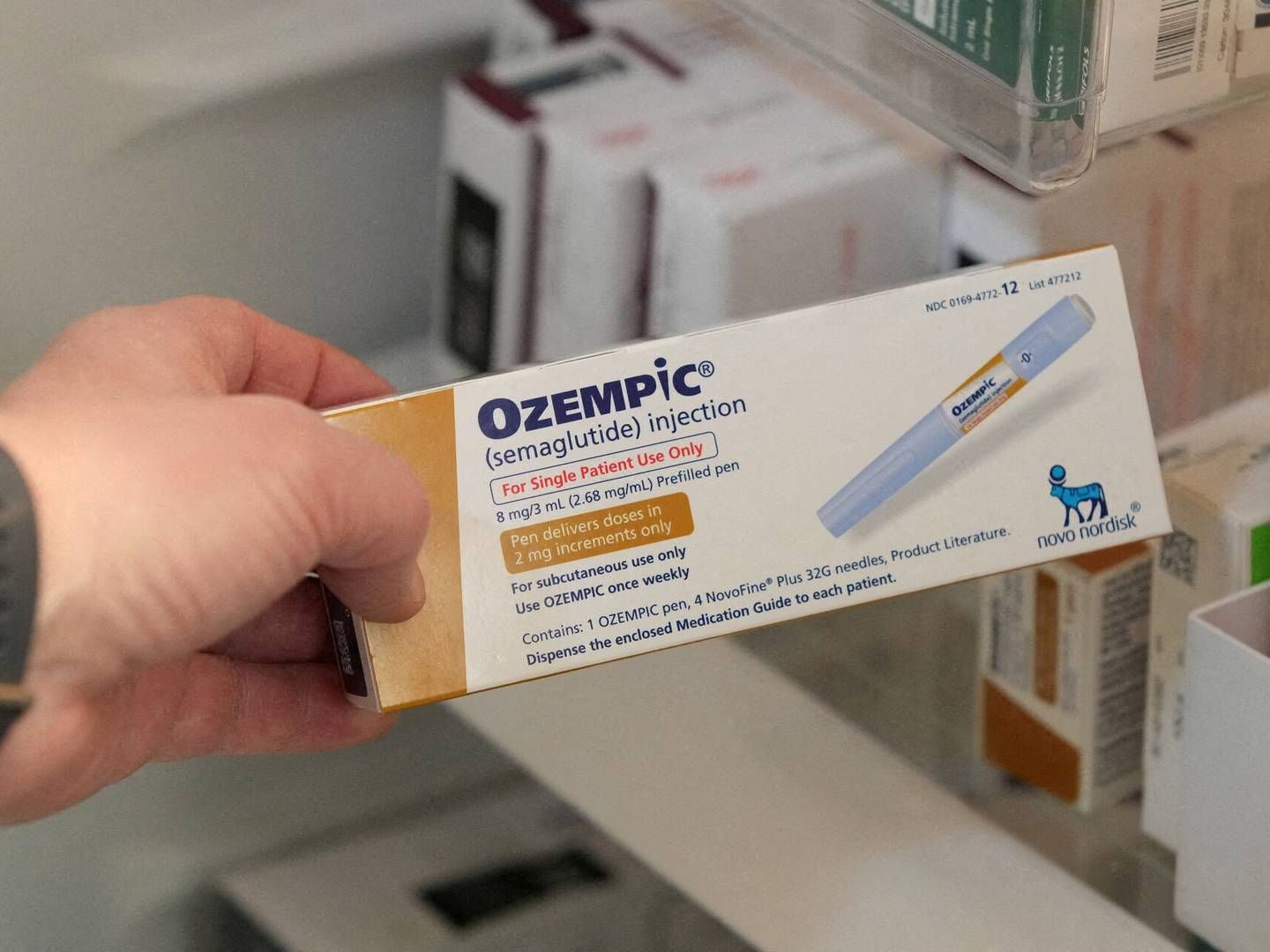

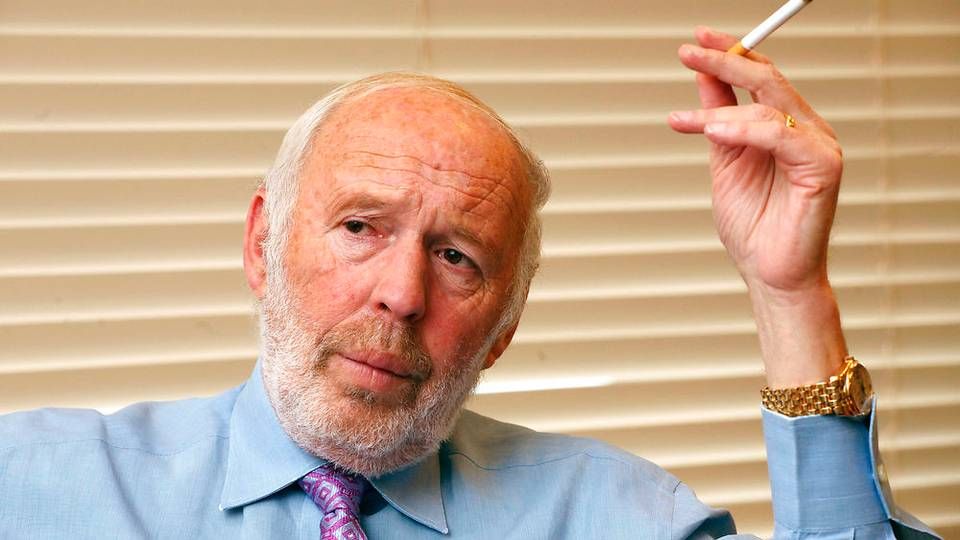

Novo Nordisk is a favorite equity of ultra-profitable hedge fund Renaissance

One of the world's most prolific investors – a real money machine – is behind the hedge fund Renaissance Technologies, which Bloomberg calls "one of the world's most profitable hedge funds. The company has a special affinity for the Danish pharmaceutical giant Novo Nordisk, shows a new security filing of the company's equity positions registered with the US Securities and Exchange Commission on March 31.

Læs hele artiklen

Få adgang i 14 dage for 0 kr. Det kræver intet kreditkort, og du vil ikke overgå til et betalt abonnement efterfølgende.